Export decline not tied to global demand, says expert

![]()

Non-oil domestic exports fell 20.7% YoY in March.

11 hours ago

Export decline not tied to global demand, says expert

Non-oil domestic exports fell 20.7% YoY in March.

11 hours ago

Gazelle Ventures offers to acquire No Signboard shares at $0.0021 apiece

The offer will close next month.

1 hour ago

Transition to zero and near-zero-emission fuels could create 700 jobs

This shift will also bring health and economic benefits.

2 hours ago

Food factory at 30 & 32 Tuas Avenue 12 up for sale for $19.0m

JLL is selling the property via private treaty.

3 hours ago

Apple CEO Tim Cook to meet with Singapore leaders: report

His trip follows Apple's US$350m campus expansion announcement in Ang Mo Kio.

4 hours ago

Singapore and Netherlands to establish container tracking service

This is Singapore’s second agreement under the Track and Trace Service.

4 hours ago

Singapore ready to tap Philippine market potential

For years, Singapore has been a top foreign investor in the Philippines.

4 hours ago

CICT NPI rises 6.3% YoY to $293.7M in 1Q24

Gross rental income growth and lower operating expenses drove the uptick.

5 hours ago

MAS issues 8-year prohibition orders to ex-Prudential rep

The former Prudential rep misappropriated $117K in premiums.

5 hours ago

Allianz Partners collaborates with MoneyHero for travel insurance

The policy is underwritten by Tokio Marine Insurance Singapore.

7 hours ago

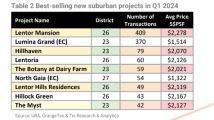

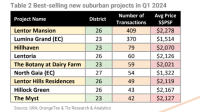

More homes in the suburbs sold at $2m price: OrangeTee

Buyers likely more willing to pay higher prices for their OCR condos.

11 hours ago

Stronger demand push condo and HDB rents higher

“Too early to call bottom.”

11 hours ago

Daily Markets Briefing: STI up 01.08%; Top stock is DBS

DBS is the top stock with a 1.334% increase.

11 hours ago

Private home sales struggle, down 5.3% in first quarter

Year-on-year. Sales dropped 3.1%.

11 hours ago

Singapore Polytechnic launches training facility for food manufacturing

The facility will provide training under the institution’s INC.

1 day ago

CICT NPI rises 6.3% YoY to $293.7M in 1Q24

5 hours ago

Stronger demand push condo and HDB rents higher

11 hours ago

Highlights

Highlights

Partner Content

Partner Content

Exclusives

Exclusives

Financial Services

Industry boosts accounting appeal with new roles, education programmes

There has been a 10% decrease in accounting degree students at universities in Singapore.

2 days ago

Top News

Export decline not tied to global demand, says expert

![]()

Non-oil domestic exports fell 20.7% YoY in March.

11 hours ago

Export decline not tied to global demand, says expert

Non-oil domestic exports fell 20.7% YoY in March.

11 hours ago

Gazelle Ventures offers to acquire No Signboard shares at $0.0021 apiece

The offer will close next month.

1 hour ago

Transition to zero and near-zero-emission fuels could create 700 jobs

This shift will also bring health and economic benefits.

2 hours ago

Food factory at 30 & 32 Tuas Avenue 12 up for sale for $19.0m

JLL is selling the property via private treaty.

3 hours ago

Apple CEO Tim Cook to meet with Singapore leaders: report

His trip follows Apple's US$350m campus expansion announcement in Ang Mo Kio.

4 hours ago

Singapore and Netherlands to establish container tracking service

This is Singapore’s second agreement under the Track and Trace Service.

4 hours ago

Singapore ready to tap Philippine market potential

For years, Singapore has been a top foreign investor in the Philippines.

4 hours ago

CICT NPI rises 6.3% YoY to $293.7M in 1Q24

Gross rental income growth and lower operating expenses drove the uptick.

5 hours ago

MAS issues 8-year prohibition orders to ex-Prudential rep

The former Prudential rep misappropriated $117K in premiums.

5 hours ago

Allianz Partners collaborates with MoneyHero for travel insurance

The policy is underwritten by Tokio Marine Insurance Singapore.

7 hours ago

More homes in the suburbs sold at $2m price: OrangeTee

Buyers likely more willing to pay higher prices for their OCR condos.

11 hours ago

Stronger demand push condo and HDB rents higher

“Too early to call bottom.”

11 hours ago

Daily Markets Briefing: STI up 01.08%; Top stock is DBS

DBS is the top stock with a 1.334% increase.

11 hours ago

Private home sales struggle, down 5.3% in first quarter

Year-on-year. Sales dropped 3.1%.

11 hours ago

Singapore Polytechnic launches training facility for food manufacturing

The facility will provide training under the institution’s INC.

1 day ago

CICT NPI rises 6.3% YoY to $293.7M in 1Q24

5 hours ago

Stronger demand push condo and HDB rents higher

11 hours ago

Partner Content

Partner Content

Highlights

Highlights

Exclusives

Financial Services

Industry boosts accounting appeal with new roles, education programmes

There has been a 10% decrease in accounting degree students at universities in Singapore.

2 days ago

Event News

Event News

NTUC LearningHub Pte Ltd wins Digital - Training and Development Award at SBR Technology Excellence Awards 2024

Co-Written / Partner

It was honoured for its significant contribution towards enhancing Singapore's tech workforce readiness.

Co-Written / Partner

NTUC LearningHub Pte Ltd wins Digital - Training and Development Award at SBR Technology Excellence Awards 2024

It was honoured for its significant contribution towards enhancing Singapore's tech workforce readiness.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?