Export decline not tied to global demand, says expert

![]()

Non-oil domestic exports fell 20.7% YoY in March.

4 hours ago

Export decline not tied to global demand, says expert

Non-oil domestic exports fell 20.7% YoY in March.

4 hours ago

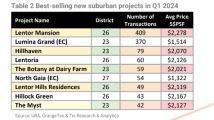

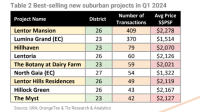

More homes in the suburbs sold at $2m price: OrangeTee

Buyers likely more willing to pay higher prices for their OCR condos.

4 hours ago

Stronger demand push condo and HDB rents higher

“Too early to call bottom.”

4 hours ago

Daily Markets Briefing: STI up 01.08%; Top stock is DBS

DBS is the top stock with a 1.334% increase.

4 hours ago

Private home sales struggle, down 5.3% in first quarter

Year-on-year. Sales dropped 3.1%.

4 hours ago

Singapore's maritime cluster navigates towards digital, green future

Adapting to emerging challenges, such as the adoption of alternative fuels, is deemed crucial for the country's maritime sector.

20 hours ago

SCG and A*STAR unveil joint labs for cellular immunotherapy enhancement

The partnership has a funding of nearly $30m supported under Singapore's Research, Innovation and Enterprise 2025 plan.

20 hours ago

Commercial redevelopment site on Orchard Road for sale for $438m

The public tender closes on Monday, 27 May 2024, at 3 pm.

20 hours ago

GDSC set to boost green jobs, health, and economic growth

It is forecasted to create over 700 new job opportunities in zero and near-zero emission fuel production.

21 hours ago

Marina Bay Sands targets 2029 completion for major expansion

Construction will begin in July 2025.

21 hours ago

Saw Choo Tatt to lead NETS Solutions as new CEO

He has over 28 years of experience in the tech industry.

21 hours ago

iWOW Tech subsidiary secures $10.7m mobile engineering contract

The contract is projected to be completed within the next 36 months.

21 hours ago

Cordlife Group aims to raise $8.04m in private placement

It issued 51.2 million new shares at $0.16 apiece.

21 hours ago

Highlights

Highlights

Partner Content

Partner Content

Exclusives

Exclusives

Financial Services

Industry boosts accounting appeal with new roles, education programmes

There has been a 10% decrease in accounting degree students at universities in Singapore.

2 days ago

Top News

Export decline not tied to global demand, says expert

![]()

Non-oil domestic exports fell 20.7% YoY in March.

4 hours ago

Export decline not tied to global demand, says expert

Non-oil domestic exports fell 20.7% YoY in March.

4 hours ago

More homes in the suburbs sold at $2m price: OrangeTee

Buyers likely more willing to pay higher prices for their OCR condos.

4 hours ago

Stronger demand push condo and HDB rents higher

“Too early to call bottom.”

4 hours ago

Daily Markets Briefing: STI up 01.08%; Top stock is DBS

DBS is the top stock with a 1.334% increase.

4 hours ago

Private home sales struggle, down 5.3% in first quarter

Year-on-year. Sales dropped 3.1%.

4 hours ago

Singapore's maritime cluster navigates towards digital, green future

Adapting to emerging challenges, such as the adoption of alternative fuels, is deemed crucial for the country's maritime sector.

20 hours ago

SCG and A*STAR unveil joint labs for cellular immunotherapy enhancement

The partnership has a funding of nearly $30m supported under Singapore's Research, Innovation and Enterprise 2025 plan.

20 hours ago

Commercial redevelopment site on Orchard Road for sale for $438m

The public tender closes on Monday, 27 May 2024, at 3 pm.

20 hours ago

GDSC set to boost green jobs, health, and economic growth

It is forecasted to create over 700 new job opportunities in zero and near-zero emission fuel production.

21 hours ago

Marina Bay Sands targets 2029 completion for major expansion

Construction will begin in July 2025.

21 hours ago

Saw Choo Tatt to lead NETS Solutions as new CEO

He has over 28 years of experience in the tech industry.

21 hours ago

iWOW Tech subsidiary secures $10.7m mobile engineering contract

The contract is projected to be completed within the next 36 months.

21 hours ago

Cordlife Group aims to raise $8.04m in private placement

It issued 51.2 million new shares at $0.16 apiece.

21 hours ago

Partner Content

Partner Content

Highlights

Highlights

Exclusives

Financial Services

Industry boosts accounting appeal with new roles, education programmes

There has been a 10% decrease in accounting degree students at universities in Singapore.

2 days ago

Event News

Event News

Singapore's tech powerhouses triumph at SBR Technology Excellence Awards 2024

Co-Written / Partner

Winning companies were awarded at Marina Bay Sands on 18 April 2024.

Co-Written / Partner

Singapore's tech powerhouses triumph at SBR Technology Excellence Awards 2024

Winning companies were awarded at Marina Bay Sands on 18 April 2024.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?